Ascende Capital

Invest in businesses

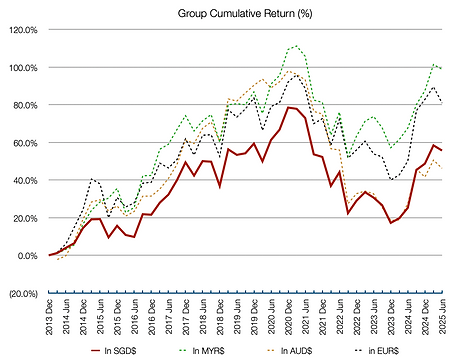

Fund Performance

Note : Performance varies in different currencies due to exchange rate movements

* Profit / Loss consists of capital gains & net dividends (less witholding tax)

Note :

- Past performance is no guarantee for future results

- Individual investor's result may vary from the group due to different join dates, deposits & withdrawals timing etc

- Differences in performances among currencies are due to currency exchange rate movements

About Ascende Capital & Co-investing

Unlike fund investing, where investors invest into a fund which then invests into a portfolio of companies, co-investing is where a group of investors, following a lead investor, each investing directly into a portfolio of companies. The end result is each investor, including the lead, owns shares directly in same portfolio of companies.

Ascende Capital is a co-investment group lead investor. The co-investor group follows the lead of Ascende Capital, investing directly in global public listed businesses, with the goal of returning long term compound average of 8 - 10% per year on investments.

Investors setup own brokerage account in their own name, and maintain full ownership & control of the account at all times. Money in the account can only be withdrawn by investors themselves.

Investor brokerage accounts are automated to follow/copy Ascende Capital’s stock investments ie. buy & sell trade executions.

Ascende Capital shares same risks / rewards as the group of investors because they all hold similar investment portfolio

Investment Philosophy

Ascende Capital’s philosophy is to invest long term in 10 - 30 good growth businesses, riding out short term market fluctuations and focus on fundamentals of the invested businesses.

We don’t do short term stock trading. We can’t time market swings & profit from them. We did try, but it was stressful & could not be successful over long period. So we invest long term like being a silent partner in a good business. Our philosophy is to treat our investments like businesses, not “stocks”. Our performance track record is mostly the result of this philosophy.

We search globally for opportunities to become long term partners in public listed growth businesses at reasonable price. We are particularly attracted to good growth businesses which encountered temporarily setbacks, allowing us to become partners at reasonable price.

Investment ideas are generated from database screening, public news flow, and company financial statements. We like growing businesses with low or no debt, generates high return on equity and long term growing stock price trend. We monitor a shortlist of these businesses we wish to own and wait for the appropriate price to invest.

We focus our investments on businesses that we think gives the best chance of returning 8 - 10% (in SGD$) per year compound average growth rate over the long term. We do change the portfolio mix as better opportunities come along, business fundamentals change or when we discover we’re wrong about certain expectations of the business.

Frequently Asked Questions

Do I give you my money to invest ?

No, you don’t give us your money. You setup your own brokerage account and transfer money into it. The account is setup to automatically buy & sell for you, the same stocks as Ascende Capital buys & sells. In other words, you follow the same stock investments as Ascende Capital, buying & selling those stocks directly through your own brokerage account.

Can Ascende Capital withdraw money from my account ?

No, you maintain full ownership & control of your account at all times. Money in your brokerage account can only be withdrawn by you. Money can only be transferred from your account to another institution that has the same account name as yours.

Do I open an account with any brokerage ?

No, you have to open an account with Interactive Brokers (IB), the same brokerage Ascende Capital uses. The automated process to follow Ascende Capital’s stock investments can only occur within IB.

Who is Interactive Brokers (IB) ? How safe are they ?

IB is one of the leading US based international broker/dealer with offices in USA, Europe & Asia. It has been in business for 41 years and is regulated by the US SEC, FINRA, NYSE, FCA and other regulatory agencies around the world. Please refer to their website https://www.interactivebrokers.com/en for more updated details.

What if IB goes bankrupt ? What will happen to my money ?

Customer securities account at IB are protected by the US Securities Investor Protection Corporation (“SIPC”) for a max coverage of US$500,000 (with a cash sublimit of US$250,000) and under IB’s excess SIPC policy for up to an additional US$30 million (with a cash sublimit of US$900,000) subject to an aggregate limit of US$150 million. Please refer to https://www.interactivebrokers.com/en/index.php?f=42767 for more details & latest updates. Please be aware the coverage provides coverage against failure of a broker-dealer, not against loss of market value of stocks.

Can I withdraw my money anytime ? How do I withdraw my funds ?

Yes, you can access your account online & transfer cash to your bank account anytime. Your stocks can be sold during market hours and converted into cash which can then be withdrawn. It usually takes same or next banking day for the money to be wired to your bank.

What reports do I get on my investments ?

You have secure online access to your IB brokerage account to view, download & print your entire portfolio & activity reports. You will also receive quarterly summary report from Ascende Capital.

Which geography markets do you invest in ?

We invest globally, but only in markets serviced by IB. At present, our portfolio is made up of Chinese, US & Australian businesses.

Isn’t it risky investing in stocks, especially in Chinese companies ?

Yes, investing in stocks, especially in developing markets is always risky. China has the best structural growth outlook & a large market. We try to be selective by only investing in the bigger & more reputable Chinese businesses, and when prices are more reasonable.

If you invest globally, does that mean my investments have currency risks ?

When your own currency depreciates, your returns are higher because the foreign stocks are now worth more in your currency. The opposite is true when the currency of foreign stocks depreciates.

How do you manage risk ?

We spread our investment across 10 - 30 businesses, and allocate more funds to the better opportunities vice versa. We prefer to spread our eggs across 10 - 30 strong baskets than spread across 100 mostly weaker baskets. The reality is good busineses at reasonable price are hard to come by.

What is your investment process ?

Investment ideas are generated from stocks database screening, public news flow, and company financial statements. We like growing businesses with low or no debt, generates 10% or higher return on assets and have long term growing stock price trend. We wait patiently for relatively lower price valuation (PE, PTB) when there’s temporary setbacks or markets are fearful. For defensive positions, we also like undervalued reputable businesses with high dividend yield.

How do I know you will be carefull with the investments ?

A large amount of my own money, my family’s, relatives’ & friends’ money are also in the investments. We buy & sell the same stocks, and have the same risks / rewards. We’re all eating the same cooking.

Do you like high risk / high reward investments ?

No, our group of co-investors are mostly retirees who are investing their own retirement funds. We treat our investments like we’re buying into businesses.

What are the costs ?

(1) Shared expenses eg. admin, IT, data subscription etc costs to be shared base on fund size. For 2019, the cost was 0.15% of fund size.

(2) Performance fee = 10% of your cumulative profit (capital gains + net dividends). If cumulative profits don’t achieve new high, there will be no performance fee charged until your cumulative profits exceed previous high.

Is there a minimum investment amount required ?

Yes, minimum starting investment amount is SGD$50,000 equivalent, and minimum account balance of SGD$100,000 equivalent within 2 years of account opening. This is due to Interactive Brokers having minimum monthly account fees. There needs to be certain scale to justify the account fees incurred.

Currently how many co-investors are there in the group ?

9.

What if something happens to you & you’re not around anymore ?

The investments are in your brokerage account under your name. The investments should be good for long term and you can choose to manage it yourself, or you can chose to liquidate the stocks and transfer the money into your bank account. The stocks can be sold anytime during market hours and your bank should typically receive the transferred funds, same or next business day.

Any criteria for joining the co-investment group ?

You have to be a long term investor & not worried by year to year fluctuations. Although you can withdraw the funds at anytime, you need to give it time to get the full benefits of investing.

How do I join the co-investment group ?

You will receive an email from IB with a special website link to apply for a brokerage account. Upon approval, you can transfer money into your account and it will be automatically linked to follow Ascende Capital’s investment executions.

Ascende Capital LLP

#16-01 100 Tras Street, Singapore 079027